Am I eligible?

You are eligible for Part A at no cost at age 65 if any of the following conditions apply:

You receive or are eligible to receive benefits from Social Security or the Railroad Retirement Board (RRB).

Your spouse (living or deceased, including a divorced spouse) receives or is eligible to receive Social Security or RRB benefits.

You or your spouse worked long enough in a government job where you paid Medicare taxes.

You are the dependent parent of a fully insured deceased child.

⭐⭐⭐⭐⭐

Happy Customers

More than 400+ clients taken care of!

Am I eligible?

You are eligible for Part A at no cost at age 65

if any of the following conditions apply:

You receive or are eligible to receive benefits from Social Security or the Railroad Retirement Board (RRB).

Your spouse (living or deceased, including a divorced spouse) receives or is eligible to receive Social Security or RRB benefits.

You or your spouse worked long enough in a government job where you paid Medicare taxes.

You are the dependent parent of a fully insured deceased child.

Medicare Eligibility Before Age 65

Before age 65, you are eligible for Medicare Part A at no cost if any of the following conditions apply:

You’ve received Social Security Disability Insurance (SSDI) benefits for 24 months.

You receive a disability pension from the Railroad Retirement Board (RRB) and meet certain conditions.

You receive SSDI benefits and have Lou Gehrig’s disease (amyotrophic lateral sclerosis).

You worked long enough in a government job where you paid Medicare taxes and have met the requirements of the SSDI program for 24 months.

You are the child or surviving spouse (age 50 or older, including a divorced surviving spouse) of a worker who has worked long enough under Social Security or in a Medicare-covered government job and meet the requirements of the SSDI program.

Kidney Failure Before Age 65

You have permanent kidney failure (end-stage renal disease) and receive maintenance dialysis or a kidney transplant, and one of the following applies:

You’ve worked long enough under Social Security or the railroad retirement system.

You’ve worked long enough in a Medicare-covered government job.

You are the child or spouse (including a divorced spouse) of a worker (living or deceased) who has worked long enough under Social Security or the railroad retirement system, or in a Medicare-covered government job.

*Note: Anyone eligible for Medicare Part A at no cost can enroll in Medicare Part B by paying a monthly premium. Those with higher incomes may have to pay a higher monthly premium for Part B.

If you are not eligible for Part A at no cost, you can purchase Part B without needing to buy Part A. To be eligible, you must be age 65 or older and meet one of the following criteria:

Be a U.S. citizen.

Be a lawfully admitted noncitizen who has lived in the United States for at least 5 years. You can only sign up for Part B during designated enrollment periods. If you don't enroll in Part B when you are first eligible, you may have to pay a late enrollment penalty for as long as you have Part B coverage.

Medicare Eligibility Before Age 65

Before age 65, you are eligible for Medicare Part A at no cost if any of the following conditions apply:

You’ve received Social Security Disability Insurance (SSDI) benefits for 24 months.

You receive a disability pension from the Railroad Retirement Board (RRB) and meet certain conditions.

You receive SSDI benefits and have Lou Gehrig’s disease (amyotrophic lateral sclerosis).

You worked long enough in a government job where you paid Medicare taxes and have met the requirements of the SSDI program for 24 months.

You are the child or surviving spouse (age 50 or older, including a divorced surviving spouse) of a worker who has worked long enough under Social Security or in a Medicare-covered government job and meet the requirements of the SSDI program.

Kidney Failure Before Age 65

You have permanent kidney failure (end-stage renal disease) and receive maintenance dialysis or a kidney transplant, and one of the following applies:

You’ve worked long enough under Social Security or the railroad retirement system.

You’ve worked long enough in a Medicare-covered government job.

You are the child or spouse (including a divorced spouse) of a worker (living or deceased) who has worked long enough under Social Security or the railroad retirement system, or in a Medicare-covered government job.

*Note: Anyone eligible for Medicare Part A at no cost can enroll in Medicare Part B by paying a monthly premium. Those with higher incomes may have to pay a higher monthly premium for Part B.

If you are not eligible for Part A at no cost, you can purchase Part B without needing to buy Part A. To be eligible, you must be age 65 or older and meet one of the following criteria:

Be a U.S. citizen.

Be a lawfully admitted noncitizen who has lived in the United States for at least 5 years. You can only sign up for Part B during designated enrollment periods. If you don't enroll in Part B when you are first eligible, you may have to pay a late enrollment penalty for as long as you have Part B coverage.

Medicare Parts A

and B – Enrollment

Initial Enrollment: The Initial Enrollment Period is a limited timeframe during which you can sign up for Original Medicare (Part A and/or Part B) when you first become eligible.

Once enrolled in Medicare Parts A and B, you have the option to choose additional coverage, such as Medicare Advantage, Medigap, or Part D, from approved private insurers.

Individuals Aged 65 or Older

Your Initial Enrollment Period is determined by the month you turn 65. It starts three months before your birth month and continues until three months after your birth month.

Your enrollment period lasts 7 months, based on the month you turn 65.

Example: If your birthday is January 12th, 1958, your enrollment period would be October 1st, 2022 - April 30th, 2023.

Medicare Parts A And B – Enrollment

Initial Enrollment: The Initial Enrollment Period is a limited timeframe during which you can sign up for Original Medicare (Part A and/or Part B) when you first become eligible.

Once enrolled in Medicare Parts A and B, you have the option to choose additional coverage, such as Medicare Advantage, Medigap, or Part D, from approved private insurers.

Individuals Aged 65 or Older

Your Initial Enrollment Period is determined by the month you turn 65. It starts three months before your birth month and continues until three months after your birth month.

Your enrollment period lasts 7 months, based on the month you turn 65.

Example: If your birthday is January 12th, 1958, your enrollment period would be October 1st, 2022 - April 30th, 2023.

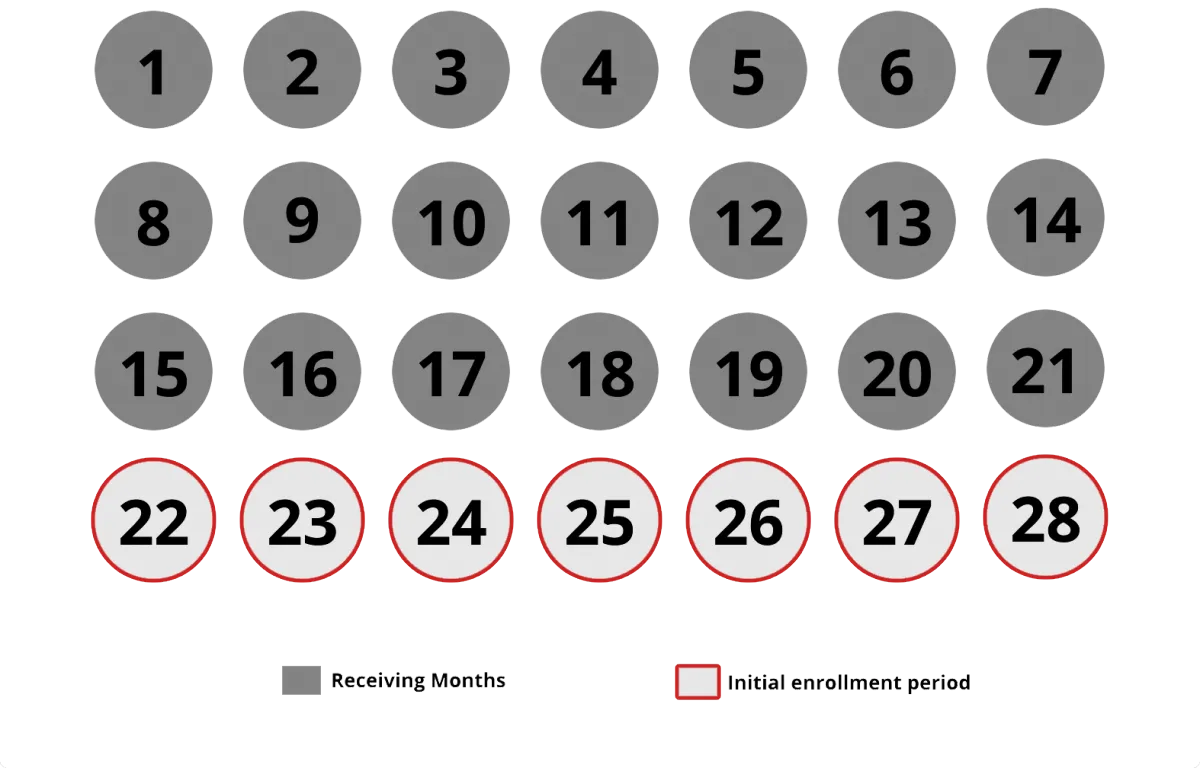

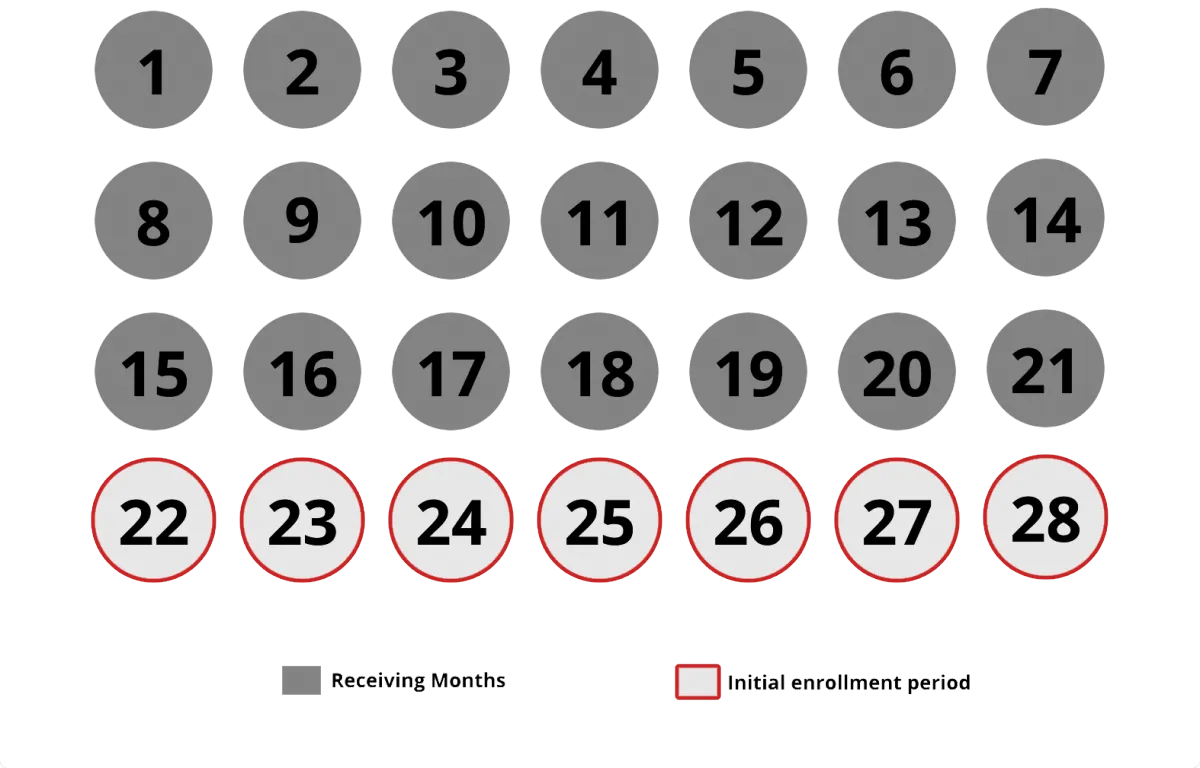

Eligible Enrollment Months:

Attention: Individuals Under Age 65 with an Eligible Disability

Your Initial Enrollment Period is determined by when you started receiving Social Security or Railroad Retirement Board (RRB) disability benefits. It begins in the 22nd month after you start receiving benefits and lasts until the 28th month after that.

Example: If you began receiving disability benefits in January 2022, your Initial Enrollment Period is from November 1, 2023 until May 31, 2023.

Attention: Individuals Under Age 65 with an Eligible Disability

Your Initial Enrollment Period is determined by when you started receiving Social Security or Railroad Retirement Board (RRB) disability benefits. It begins in the 22nd month after you start receiving benefits and lasts until the 28th month after that.

Example: If you began receiving disability benefits in January 2022, your Initial Enrollment Period is from November 1, 2023 until May 31, 2023.

How To Enroll

If you already receive Social Security or certain retirement benefits, you may be automatically enrolled in Original Medicare during this time period.

Open Enrollment Period

(October 15 through December 7)

The Medicare Open Enrollment Period offers an annual chance to review and modify your Medicare coverage.

You can:

Enroll in a Medicare Advantage (Part C) plan.

Discontinue your Medicare Advantage plan and switch back to Original Medicare (Part A and Part B).

Switch from one Medicare Advantage plan to another.

Add or adjust your Prescription Drug.

Coverage (Part D) plan if you are enrolled in Original Medicare.

General Enrollment Period

(January 1 through March 31)

The General Enrollment Period presents an annual chance to enroll in Medicare Part A and/or Part B.

You can:

Sign up for Original Medicare if you weren't automatically enrolled and missed your Initial Enrollment Period.

Enroll in Part B if you have chosen to opt out of automatic enrollment or have previously dropped your coverage.

Note: If you enroll in Part B after your Initial Enrollment Period, you may incur higher premiums unless you qualify for a Special Enrollment Period.

If you enroll in Medicare during this period, your coverage begins on July 1.

* Note: In certain situations, you may qualify for a Special Enrollment Period. This period provides an opportunity to enroll in the Medicare program or make changes to your Medicare options outside of the Initial and annual Open Enrollment Periods.

How To Enroll

If you already receive Social Security or certain retirement benefits, you may be automatically enrolled in Original Medicare during this time period.

Open Enrollment Period

(October 15 through December 7)

The Medicare Open Enrollment Period offers an annual chance to review and modify your Medicare coverage.

You can:

Enroll in a Medicare Advantage (Part C) plan.

Discontinue your Medicare Advantage plan and switch back to Original Medicare (Part A and Part B).

Switch from one Medicare Advantage plan to another.

Add or adjust your Prescription Drug.

Coverage (Part D) plan if you are enrolled in Original Medicare.

General Enrollment Period

(January 1 through March 31)

The General Enrollment Period presents an annual chance to enroll in Medicare Part A and/or Part B.

You can:

Sign up for Original Medicare if you weren't automatically enrolled and missed your Initial Enrollment Period.

Enroll in Part B if you have chosen to opt out of automatic enrollment or have previously dropped your coverage.

Note: If you enroll in Part B after your Initial Enrollment Period, you may incur higher premiums unless you qualify for a Special Enrollment Period.

If you enroll in Medicare during this period, your coverage begins on July 1.

* Note: In certain situations, you may qualify for a Special Enrollment Period. This period provides an opportunity to enroll in the Medicare program or make changes to your Medicare options outside of the Initial and annual Open Enrollment Periods.

FAQ's

Frequently Asked Questions

Automatic Enrollment:

Question: Will I be automatically enrolled in Medicare?

You will be automatically enrolled in Medicare Part A and Part B if you reach age 65 and receive Social Security or Railroad Retirement Board (RRB) retirement benefits. You will also be automatically enrolled if you are under age 65 with an eligible disability.

You will receive a Medicare card in the mail three months before your 65th birthday or your 25th month of disability. It will include instructions for opting out of enrollment for Part B, should you wish to do so.

Manual Enrollment:

If you are not already receiving Social Security benefits, you will not receive a reminder letter. The enrollment period is crucial: you can start signing up three months before your 65th birthday and have until three months after your birth month to complete the process.

Missing this deadline could result in higher premiums.

Question: How do I manually enroll in Medicare?

There are 3 enrollment periods for Medicare. It's important to sign up as soon as possible to avoid penalties or gaps in coverage. You can sign up at: https://www.ssa.gov/medicare/sign-up

FAQ's

Frequently

Asked Questions

Automatic Enrollment:

Question: Will I be automatically enrolled in Medicare?

You will be automatically enrolled in Medicare Part A and Part B if you reach age 65 and receive Social Security or Railroad Retirement Board (RRB) retirement benefits. You will also be automatically enrolled if you are under age 65 with an eligible disability.

You will receive a Medicare card in the mail three months before your 65th birthday or your 25th month of disability. It will include instructions for opting out of enrollment for Part B, should you wish to do so.

Manual Enrollment:

If you are not already receiving Social Security benefits, you will not receive a reminder letter. The enrollment period is crucial: you can start signing up three months before your 65th birthday and have until three months after your birth month to complete the process.

Missing this deadline could result in higher premiums.

Question: How do I manually enroll in Medicare?

There are 3 enrollment periods for Medicare. It's important to sign up as soon as possible to avoid penalties or gaps in coverage. You can sign up at: https://www.ssa.gov/medicare/sign-up

Looking for a First-Class Medicare Consultant?

Looking for a First-Class Medicare Consultant?

Affordable Healthcare Alliance is committed to serving you at the highest level with all your Medicare needs.

National Producer Number: 19316388

DISCLAIMER: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Company

Directories

Legal

Affordable Healthcare Alliance is committed to serving you at the highest level with all your Medicare needs.

National Producer Number: 19316388

DISCLAIMER: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Company

Directories

Legal